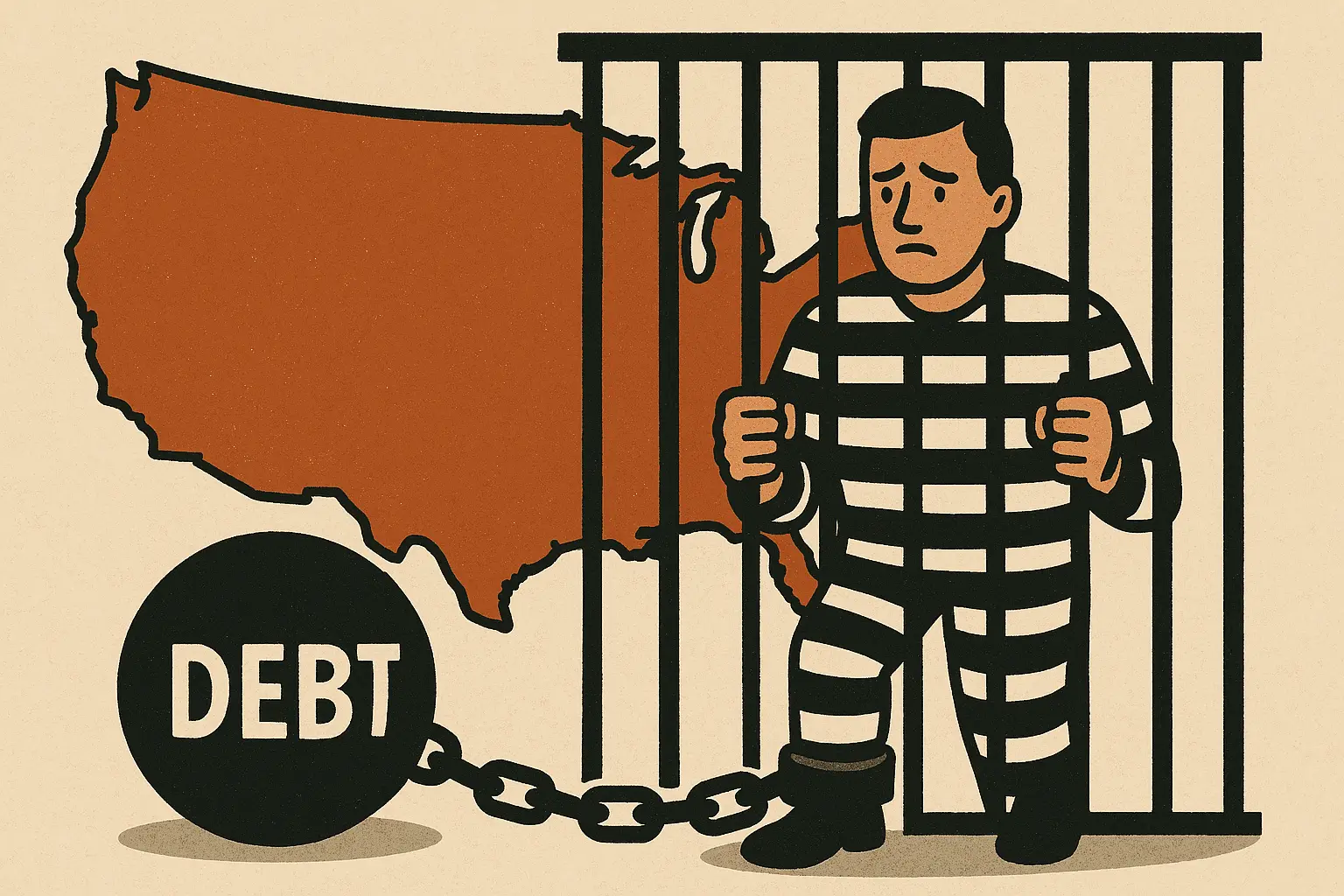

Many people believe that debtors' prisons—where individuals are jailed for failing to pay their debts—no longer exist in the United States. While they were officially abolished in the 1830s, certain legal loopholes still allow people to be jailed for debt-related issues. For instance, a Harvard-led study found that between 2005 and 2018, Texas courts jailed individuals for failure to pay fines and fees approximately 38,000 times annually, while Wisconsin courts did so about 8,000 times each year.

Understanding the laws surrounding debt and potential jail time is crucial, especially if you're struggling with unpaid debts like credit cards, medical bills, or payday loans. This article will explore the states where you can still be jailed for debt and how to protect yourself from legal action.

Understanding how debt interacts with the legal system can help you avoid unnecessary consequences. With this in mind, let’s explore the specific debts that can lead to serious legal consequences in more detail.

Officially, you cannot be jailed just for owing money on personal loans, credit cards, or other consumer debt. However, in some cases, failing to respond to lawsuits from creditors or ignoring a court summons can result in a bench warrant for your arrest. This means you could end up in jail—not directly for debt, but for failing to follow court orders.

Certain debts, such as unpaid child support, court fines, and some tax debts, carry a higher risk of imprisonment since they are considered legal obligations rather than private debts. A report by the American Civil Liberties Union (ACLU) highlighted that thousands of debtors are arrested and jailed each year because they owe money, with millions more threatened with jail.

While no state explicitly allows jailing people for debt, some states have loopholes that can lead to debt-related arrests. Here are some states where people have been jailed due to unpaid debt-related issues:

1. Illinois

In one instance, an Illinois resident was jailed over a failure to appear notice despite being unaware that a debt collector had brought proceedings against her.

2. Minnesota

3. Ohio

4. Missouri

5. Indiana

6. South Carolina

7. Texas, Georgia, Oklahoma, and Pennsylvania

It's important to note that in Texas, between 2005 and 2018, courts jailed individuals for failure to pay fines and fees approximately 38,000 times annually.

Debt collectors cannot directly jail individuals, but they often use the legal system to pressure people into paying. Some common tactics include:

For example, some people ask, "Can you go to jail if a credit card company sues you?" While the lawsuit itself won’t lead to jail, ignoring a court summons might.

Certain debts have legal consequences, including:

Online payday loans have become a popular way for people to deal with urgent expenses, but failing to repay can still result in aggressive collection tactics.

You have legal protections against aggressive debt collection. The Fair Debt Collection Practices Act (FDCPA) prohibits unfair collection tactics, including harassment and threats of jail time.

Your Rights When Sued for Debt

If you live in Texas, knowing your rights regarding payday loans in Texas can help you make informed financial decisions.

If you’re concerned about debt-related legal issues, take the following steps:

In some cities, like Austin, Texas, many borrowers rely on online payday loans in Austin for short-term financial relief. Knowing the risks and repayment obligations is key to avoiding legal trouble.

No, you cannot be jailed for failing to repay a personal loan. Debtors' prisons were abolished in the U.S. in the 19th century. However, if a creditor sues you and you ignore a court order or fail to appear in court, a judge may issue a warrant for your arrest for contempt of court. It's crucial to respond to all court summons to avoid such situations.

No, you cannot be arrested for unpaid credit card debt. While creditors can pursue legal action to recover the owed amount, this is a civil matter, not a criminal one. However, failing to comply with court orders resulting from such lawsuits can lead to legal consequences, including potential jail time for contempt of court. Always respond to legal notices and attend all court proceedings.

No, you cannot be jailed for failing to pay debts in collections. Debt collectors may use aggressive tactics, but they cannot threaten you with arrest. However, if a lawsuit is filed and you fail to respond or comply with court orders, it could lead to legal issues, including possible jail time for contempt.

If a creditor wins a lawsuit against you and you fail to comply with the court's judgment—such as not appearing for a debtor's examination or refusing to provide financial information—the court may hold you in contempt, which can result in jail time. It's essential to adhere to all court orders to avoid such outcomes.

Being sued by a credit card company is a civil matter. You won't be jailed for the debt itself. However, ignoring the lawsuit or failing to comply with subsequent court orders can lead to contempt of court charges, which may result in jail time. Always respond to legal notices and attend all court proceedings.

In Texas, you cannot be jailed directly for unpaid medical bills. However, if a healthcare provider or debt collector sues you and you fail to respond to a court summons or comply with court orders, the judge may hold you in contempt, leading to potential jail time. It's vital to address all legal notices promptly and adhere to court requirements to avoid such consequences.

Pennsylvania does not imprison individuals solely for owing debts. Nonetheless, if you disregard court orders related to a debt—such as failing to appear in court or not complying with a court-mandated payment plan—you could be found in contempt of court, which can result in jail time. Ensuring compliance with all legal proceedings is crucial to prevent incarceration.

While you cannot technically go to jail just for owing money, failure to respond to debt-related lawsuits can lead to legal trouble in states where you can go to jail for debt due to contempt of court. By understanding your rights and legal protections, you can take steps to avoid unnecessary court actions and financial distress.

If you’re facing a debt lawsuit, seek legal advice and respond to court notices to prevent any risks of jail time. Debt is stressful, but knowing your options and rights can make a difference.